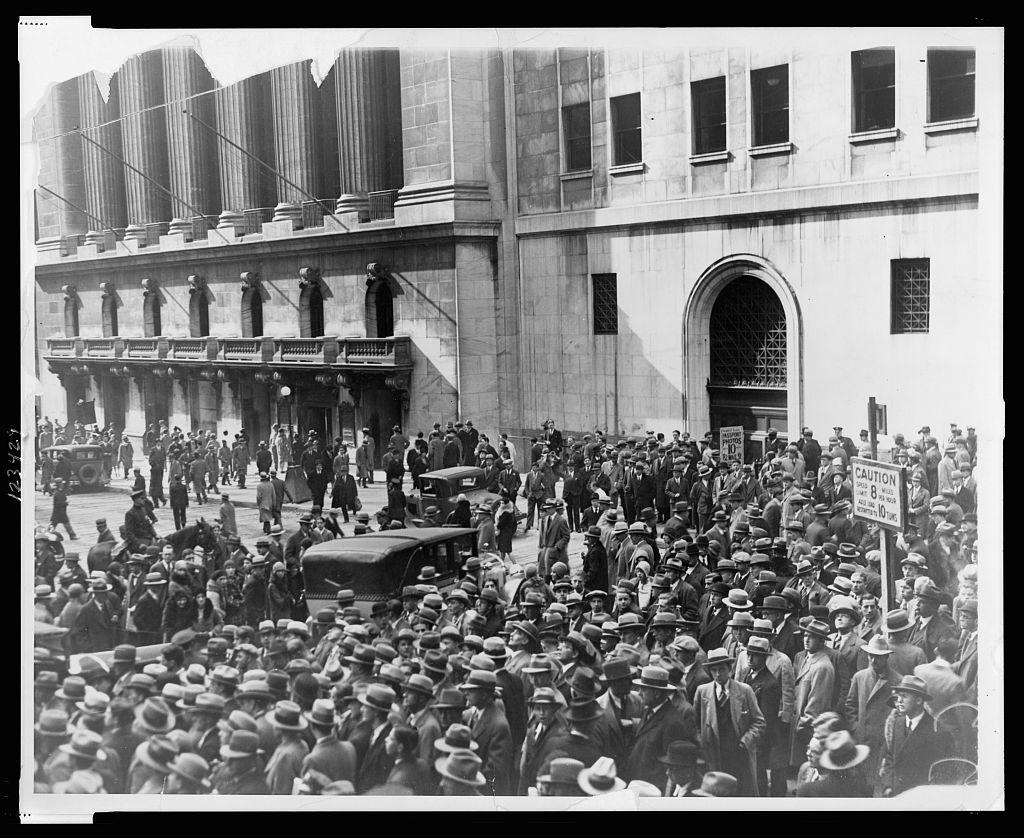

Image Credit: Crowd of people gather outside the New York Stock Exchange following the Crash of 1929, photo: Library of Congress

One of the best ways to make sure the easy gains of the past 10 years haven’t made you complacent is to look back at the Crash of 1929.

Ninety years ago this week, the worst stock-market crash in U.S. history began. Almost everything today’s investors think about that pivotal event is wrong—and anyone who believes it’s irrelevant is wrong about that, too.

Everybody “knows” the market collapsed in 1929 because euphoric speculators bingeing on borrowed money drove stocks to absurd heights. That isn’t true.

Didn’t leading forecasters warn that a crash was coming? Not exactly.

Did anyone predict how long it would last and how bad it would get? Not even close.

Doesn’t the 1929 crash prove that if you hold stocks long enough, you’re bound to come out ahead? Only if you have the patience of a tortoise and the emotions of a stone….

Read the rest of the column

This article was originally published on The Wall Street Journal.

Further reading

Benjamin Graham, The Intelligent Investor

Jason Zweig, The Devil’s Financial Dictionary

Jason Zweig, Your Money and Your Brain

Jason Zweig, The Little Book of Safe Money