Image Credit: Brian Stauffer

Imagine millions of investors losing money and not caring—perhaps not even noticing.

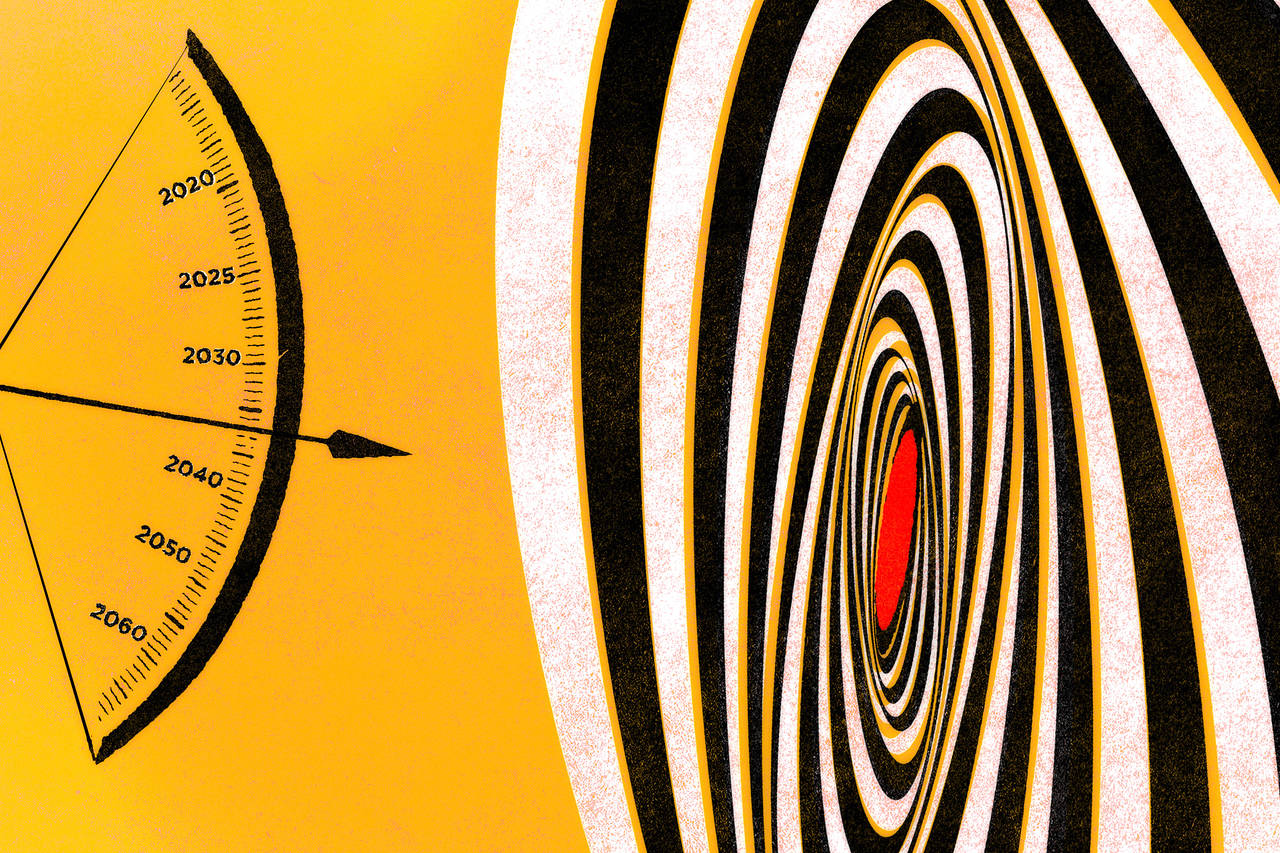

Among the 652 target-date funds that existed as of Dec. 31, 2018, every single one lost money last year, according to Morningstar. The average drop among these funds, which are customized for retirement savers, was 6.2% in a year when the S&P 500 fell 4.4%.

Nevertheless, these prepackaged bundles of stocks and bonds took in an estimated $36 billion in new money in the first seven months of 2019. That brought total assets to $1.27 trillion, says Morningstar analyst Jeff Holt.

Target-date funds have become the favorite vehicle in 401(k) plans—and the future of this bull market in stocks depends heavily on the durability of the behavior they foster.…

Read the rest of the column

This article was originally published on The Wall Street Journal.

Further reading

Benjamin Graham, The Intelligent Investor

Jason Zweig, The Devil’s Financial Dictionary

Jason Zweig, Your Money and Your Brain

Jason Zweig, The Little Book of Safe Money