Next month, the respected investor Howard Marks is coming out with a new book, Mastering the Market Cycle, whose title might inspire many readers to scour it for evidence that short-term market timing can work.

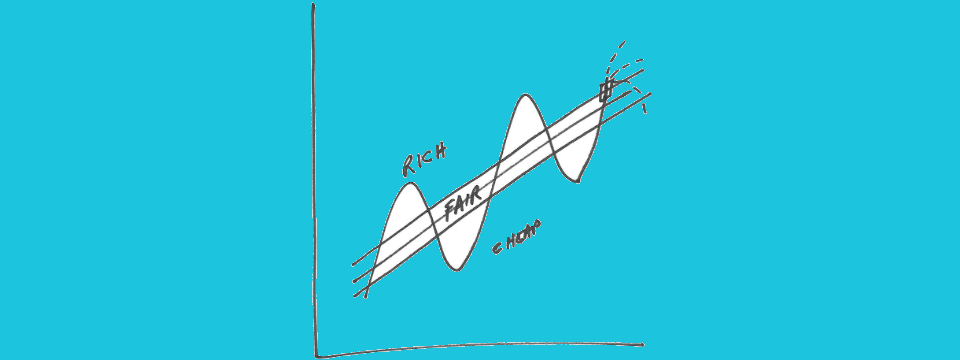

They will look in vain. You should scale back or crank up the level of risk you take in the markets, says Mr. Marks—but only when signs of euphoria or despair become extreme. The more often you do change your stance, the less likely you are to be relying on valid indicators.

To be sure, Mr. Marks warned in early 2007 that the mortgage market was overheating. In October 2008, with the stock and bond markets in free-fall, he wrote: “When others conduct their affairs with excessive negativism, it’s worth being positive.” As a result, Oaktree Capital Management, the Los Angeles-based investment firm that Mr. Marks co-founded and co-chairs, largely avoided the buy-high-sell-low behavior that devastated so many other investors during the financial crisis a decade ago….

Read the rest of the column

This article was originally published on The Wall Street Journal.

Further reading

Benjamin Graham, The Intelligent Investor

Jason Zweig, The Devil’s Financial Dictionary

Jason Zweig, Your Money and Your Brain

Jason Zweig, The Little Book of Safe Money

Samuel Lee, “The Danger in Valuation-Based Market Timing,” SVRN Asset Management blog

“Capital Recycling at Elevated Valuations: A Historical Simulation,” Philosophical Economics blog

Howard Marks’ investment memos at Oaktree Capital Management’s website

A Rediscovered Masterpiece by Benjamin Graham

This Simple Way Is the Best Way to Predict the Market

Stocks Are Probably Overpriced, But Don’t Be Too Sure